May 13, 2021

2021 Charitable Incentives under the CARES Act

Categories: Donors, Philanthropy, Legal, Response and Recovery,

In 2020, the CARES Act was passed to provide relief to individuals, businesses, and nonprofit organizations during the COVID-19 pandemic, and it created new charitable incentives to encourage individuals to make charitable gifts during this time.

These charitable incentives (listed below) have been extended into 2021.

- Individuals who do not itemize and instead take the standard deduction on their personal tax returns may also take an above-the-line universal charitable deduction in the amount of $300 provided they have made a cash gift in this amount during the tax year. In 2020, the above-the-line $300 charitable deduction was per tax return. In 2021, a husband and wife filing a joint tax return may each take the $300 deduction (a total of $600) on the tax return.

- Excludes gifts made from donor advised funds (DAFs) and supporting organizations.

- Excludes gifts made from donor advised funds (DAFs) and supporting organizations.

- Individuals who make large cash gifts to a 501c3 public charity in 2021 may deduct up to 100% of their Adjusted Gross Income.

- Excludes gifts made from donor advised funds (DAFs) and supporting organizations.

- Donors may make large cash gifts to their donor advised fund but will only be able to deduct up to 60% of their Adjusted Gross Income.

While these incentives exclude donor advised funds, a donor may work with the Community Foundation of Sarasota County by making cash gifts to any one of our Season of Sharing funds, which is not a donor advised fund, or may make a cash gift to other types of funds at the Community Foundation.

Required Minimum Distribution (RMD)

In 2020, the CARES Act waived an individual’s requirement to withdraw their required minimum distribution (RMD) from their IRA account. This waiver was not extended in 2021.

So if you are 72 and you must take a required minimum distribution this year and you do not wish to bring it into your current income because it will take you to a higher tax bracket (and you do not need the money), you may instead gift your RMD to a 501c public charity, including the Community Foundation.

However, the IRS prohibits donors from gifting IRA rollover money into a donor advised fund. You instead may gift it to our Season of Sharing funds or another designated fund or scholarship fund administered our organization. It is recommended you reach out to our Philanthropy Team to discuss this strategy.

Appreciated Stock

The stock market has been at unprecedented highs over the last year. If you hold appreciated stock which you have owned for more than a year with a low cost basis, this is a good year to consider gifting stock. The advantages are as follows:

- You may deduct the full fair market value of the appreciated stock.

- You avoid paying capital gain tax.

- More money is given to charity, than if you sold the stock, paid capital gain tax and gifted the net proceeds to the charity.

- A stock gift may be contributed to a donor advised fund.

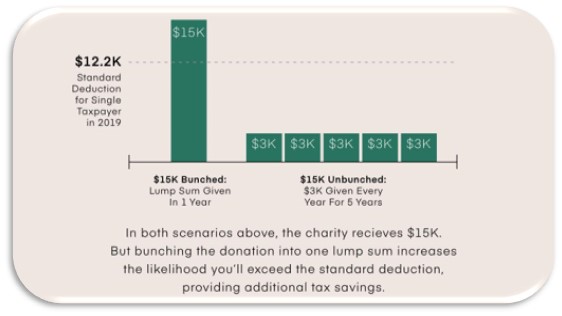

Further, with a large stock gift, this may be a year to consider “bunching your gift”. If you normally take the standard deduction and do not itemize on your tax return, this year you may want to consider making a large stock gift which is greater than your standard deduction and put such gift into a donor advised fund. You will itemize this stock gift on your 2021 tax return.

An example of "bunching your gift."

An example of "bunching your gift."

You will use your donor advised fund to make your annual gifts over the next two years. The following year, you will go back to taking the standard deduction.

With this and any other charitable consideration, the Philanthropy Team and I would be happy to continue this conversation and discuss your philanthropic dreams and goals. We're here and listening, now and always.