October 15, 2020

Gifting Appreciated Stock

Categories: Leadership,

Gifting appreciated stock you have held for more than a year allows you to deduct the full fair market value on the date of the gift while avoiding paying capital gains tax if you had sold the stock before gifting. This provides more money to charity, and the gift may be contributed to a donor advised fund which can be used over time to support nonprofit organizations and charitable cause you care about.

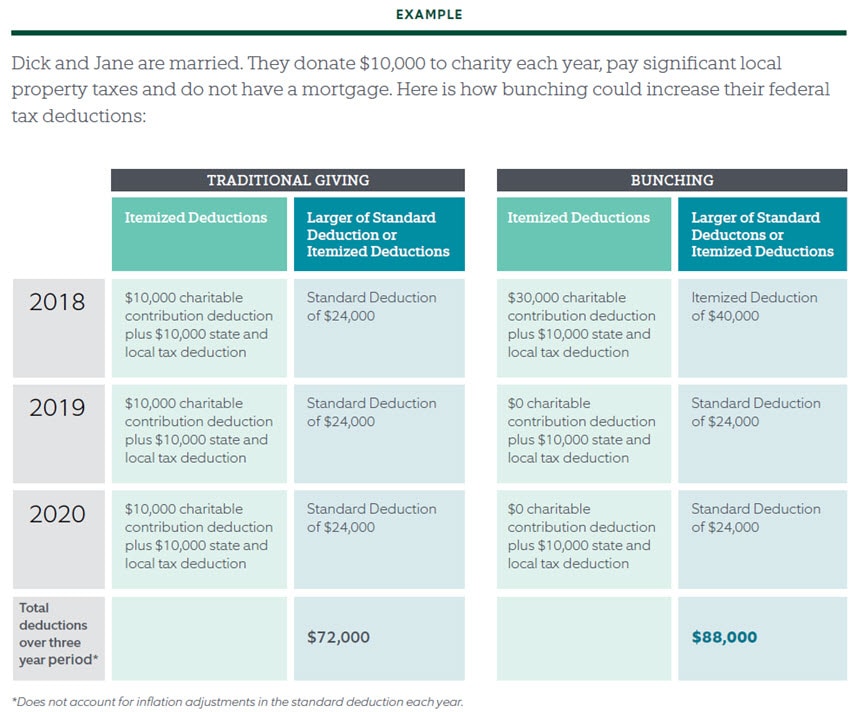

Further, making a large gift of appreciated stock in 2020 would allow you to take advantage of “bunching” your gift. You contribute your stock to a donor advised fund and itemize the full gift on your 2020 tax return. The following tax year, you take the standard deduction and use the donor advised fund to make your 2021 annual gifts.

An example of bunching your charitable contributions. Image: Northern Trust